A Tax Deferred Employee Benefit Is

A Tax Deferred Employee Benefit Is - As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts.

As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts.

As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts.

Deferred Tax Asset Create and Calculate Deffered Tax in Accounting

As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as. As described, defined benefit plans provide significant tax savings to both employers and employees.

Deferred Tax Deferred Tax in Accounting Standards

Distributions from the plan are taxed as. As per chegg policy, i can answer first four parts. As described, defined benefit plans provide significant tax savings to both employers and employees.

Deferred Tax Asset Calculation Example Balance Sheet Verkanarobtowner

As described, defined benefit plans provide significant tax savings to both employers and employees. As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as.

Deferred Tax Liability astonishingceiyrs

As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as. As described, defined benefit plans provide significant tax savings to both employers and employees.

TaxDeferred Growth uDirect IRA Services, LLC

Distributions from the plan are taxed as. As described, defined benefit plans provide significant tax savings to both employers and employees. As per chegg policy, i can answer first four parts.

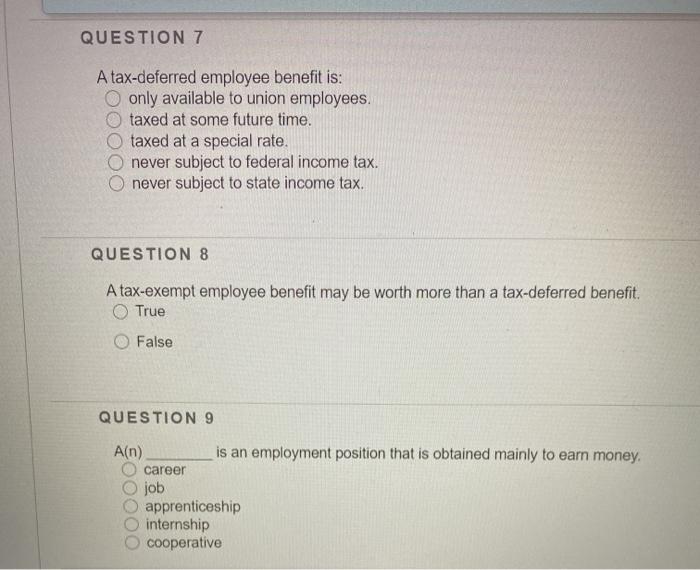

Solved QUESTION 7 A taxdeferred employee benefit is only

As per chegg policy, i can answer first four parts. As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as.

TaxDeferred Investments Definition, Types, Pros, and Cons

As described, defined benefit plans provide significant tax savings to both employers and employees. As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as.

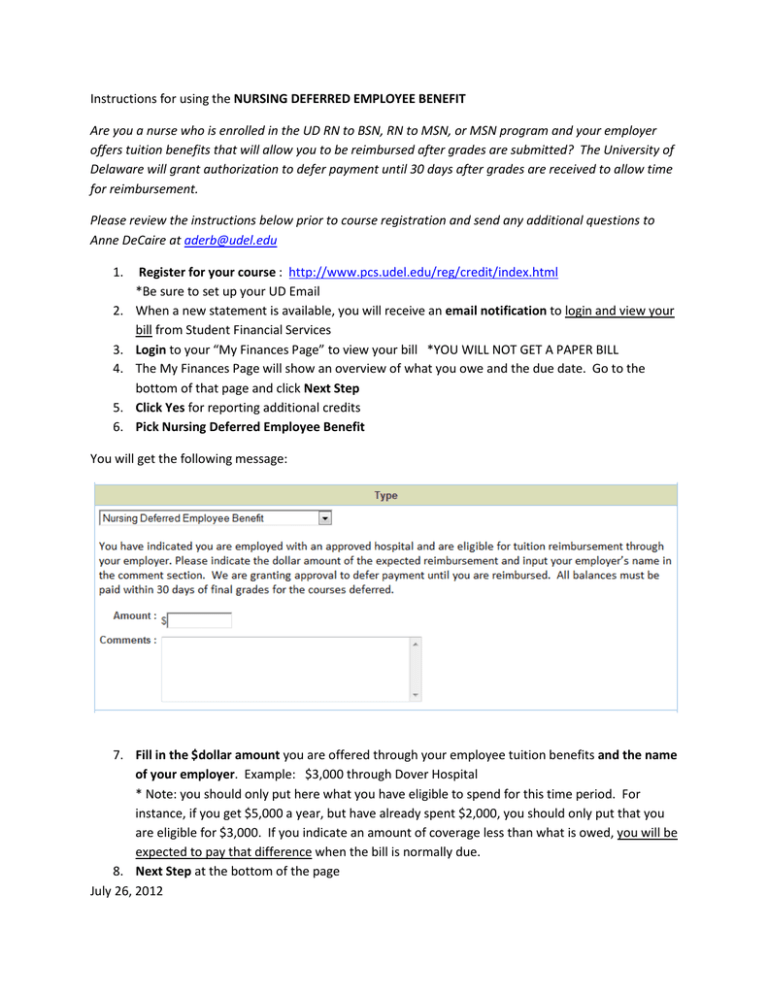

NURSING DEFERRED EMPLOYEE BENEFIT

As described, defined benefit plans provide significant tax savings to both employers and employees. As per chegg policy, i can answer first four parts. Distributions from the plan are taxed as.

What Is A TaxDeferred Retirement Plan? (2024)

Distributions from the plan are taxed as. As described, defined benefit plans provide significant tax savings to both employers and employees. As per chegg policy, i can answer first four parts.

As Per Chegg Policy, I Can Answer First Four Parts.

As described, defined benefit plans provide significant tax savings to both employers and employees. Distributions from the plan are taxed as.