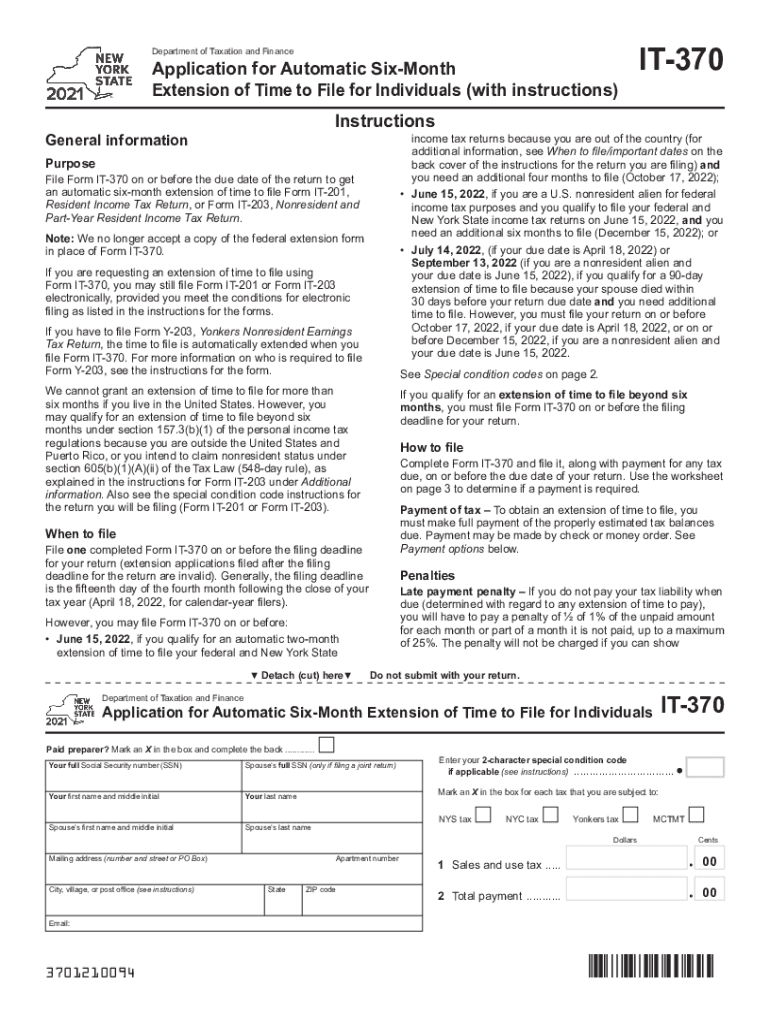

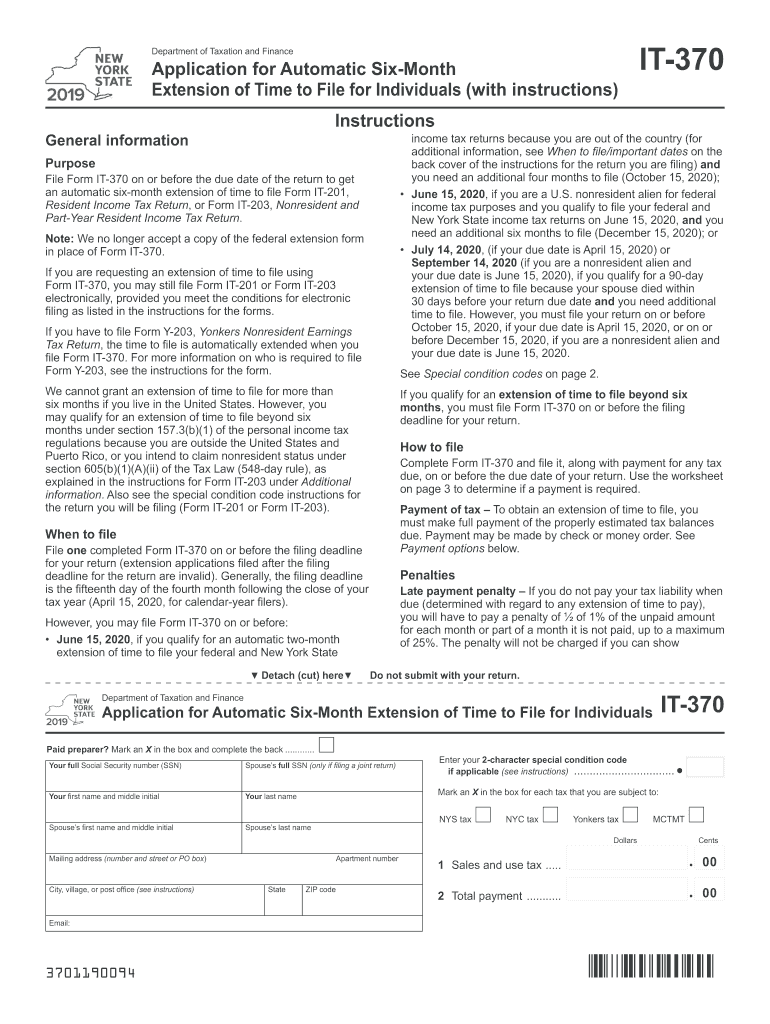

Nys Income Tax Extension Form It 370

Nys Income Tax Extension Form It 370 - If you can't file on time, you can request an automatic extension of time to file the following. Any balance due with this automatic extension of time to file. If you file your extension application after the filing deadline for the return: Income tax applications for filing extensions. Make the check or money order. Get more information if you need to.

Make the check or money order. Any balance due with this automatic extension of time to file. Get more information if you need to. Income tax applications for filing extensions. If you can't file on time, you can request an automatic extension of time to file the following. If you file your extension application after the filing deadline for the return:

If you file your extension application after the filing deadline for the return: Income tax applications for filing extensions. If you can't file on time, you can request an automatic extension of time to file the following. Any balance due with this automatic extension of time to file. Get more information if you need to. Make the check or money order.

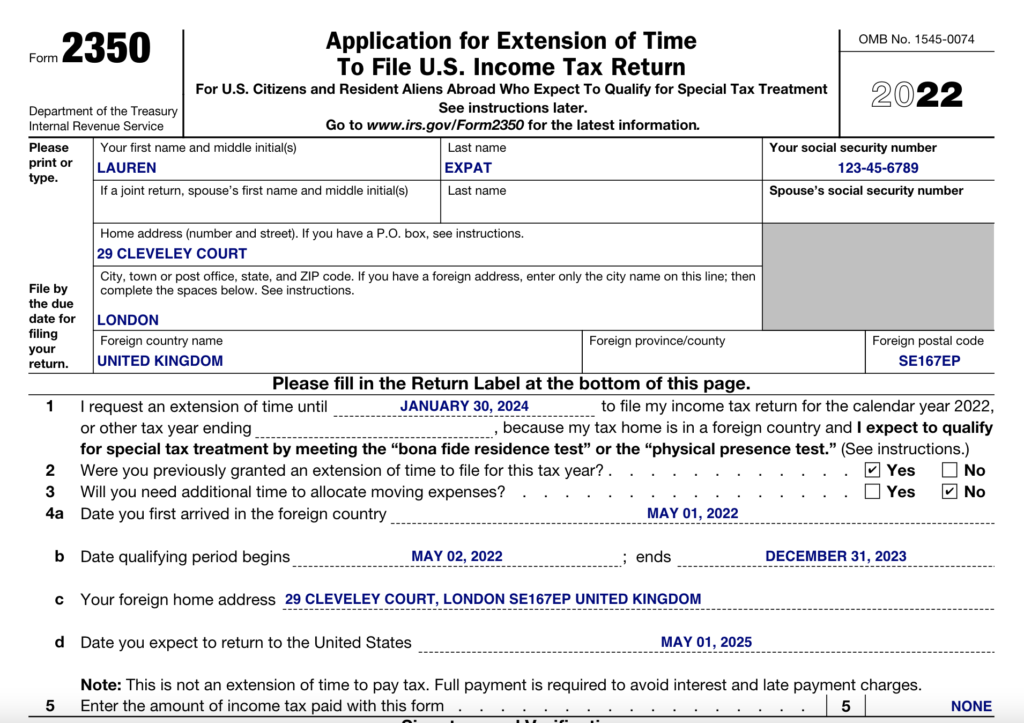

Tax Extension Form 2024 Betti Chelsea

If you can't file on time, you can request an automatic extension of time to file the following. Make the check or money order. Income tax applications for filing extensions. Get more information if you need to. If you file your extension application after the filing deadline for the return:

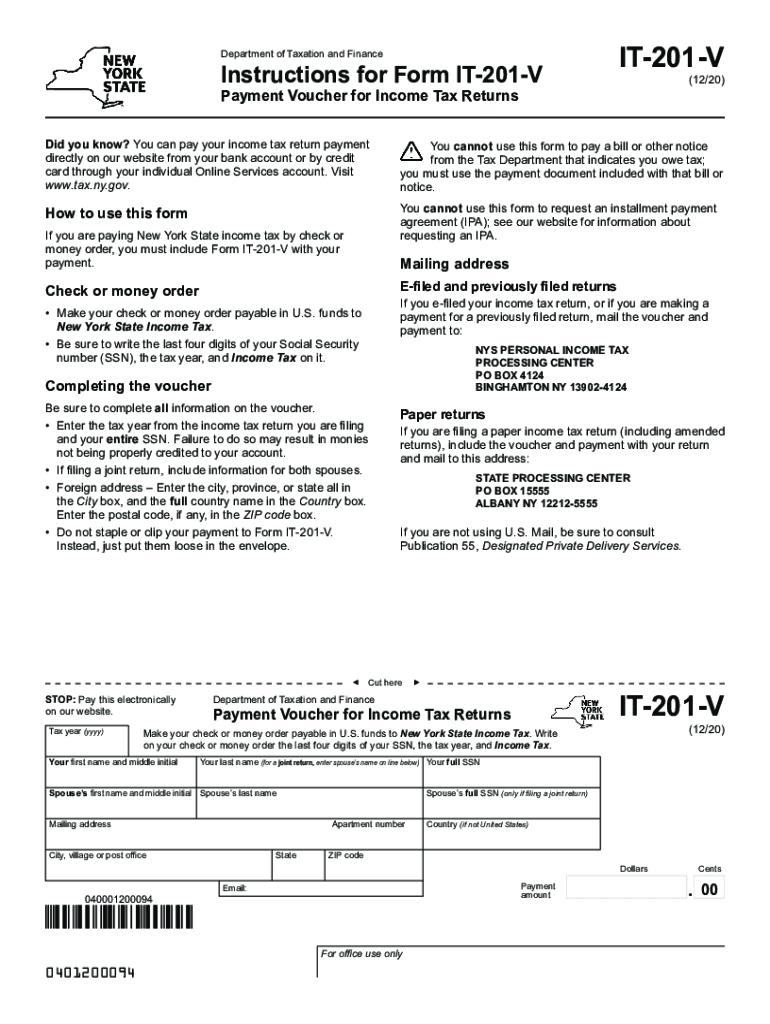

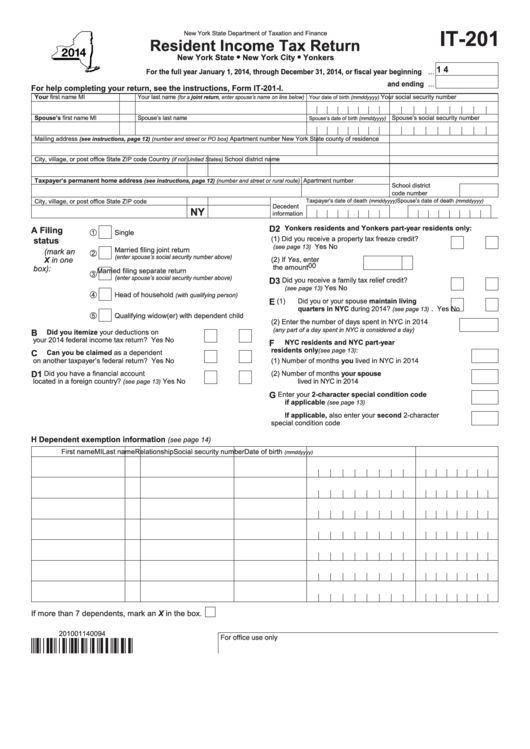

Fillable Online New York State Tax Form 201 Instructions Fax

Get more information if you need to. Make the check or money order. If you can't file on time, you can request an automatic extension of time to file the following. If you file your extension application after the filing deadline for the return: Income tax applications for filing extensions.

Fill Free fillable forms for New York State

Any balance due with this automatic extension of time to file. Make the check or money order. Income tax applications for filing extensions. If you file your extension application after the filing deadline for the return: If you can't file on time, you can request an automatic extension of time to file the following.

Nys Fillable Tax Form Printable Forms Free Online

If you can't file on time, you can request an automatic extension of time to file the following. Make the check or money order. Get more information if you need to. Any balance due with this automatic extension of time to file. Income tax applications for filing extensions.

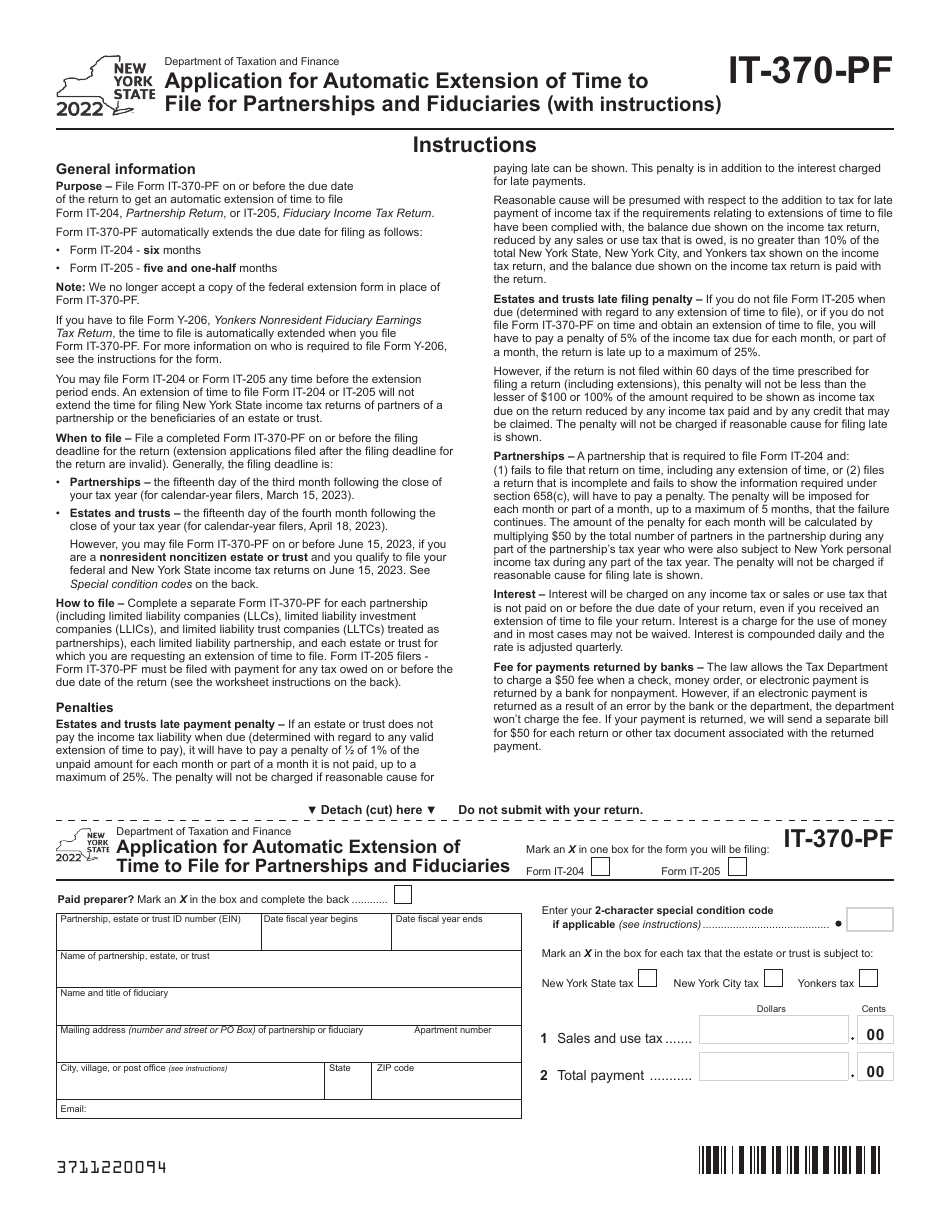

Form IT370PF Download Fillable PDF or Fill Online Application for

If you can't file on time, you can request an automatic extension of time to file the following. Any balance due with this automatic extension of time to file. Make the check or money order. Get more information if you need to. Income tax applications for filing extensions.

New york state tax forms get Fill out & sign online DocHub

If you can't file on time, you can request an automatic extension of time to file the following. Any balance due with this automatic extension of time to file. Income tax applications for filing extensions. Get more information if you need to. Make the check or money order.

Tax Extension Form 2024 Drona Ainslee

Any balance due with this automatic extension of time to file. Income tax applications for filing extensions. If you file your extension application after the filing deadline for the return: If you can't file on time, you can request an automatic extension of time to file the following. Make the check or money order.

NY DTF IT201 2025 Form Printable Blank PDF Online

Any balance due with this automatic extension of time to file. Make the check or money order. Income tax applications for filing extensions. Get more information if you need to. If you file your extension application after the filing deadline for the return:

Ny State it 370 20192024 Form Fill Out and Sign Printable PDF

Any balance due with this automatic extension of time to file. If you file your extension application after the filing deadline for the return: If you can't file on time, you can request an automatic extension of time to file the following. Make the check or money order. Get more information if you need to.

Form It370 2015 Department Of Taxation And Finance Application For

Any balance due with this automatic extension of time to file. Income tax applications for filing extensions. If you can't file on time, you can request an automatic extension of time to file the following. Get more information if you need to. Make the check or money order.

Get More Information If You Need To.

If you can't file on time, you can request an automatic extension of time to file the following. If you file your extension application after the filing deadline for the return: Any balance due with this automatic extension of time to file. Make the check or money order.